New year begins with declines as fewer mega projects break ground.

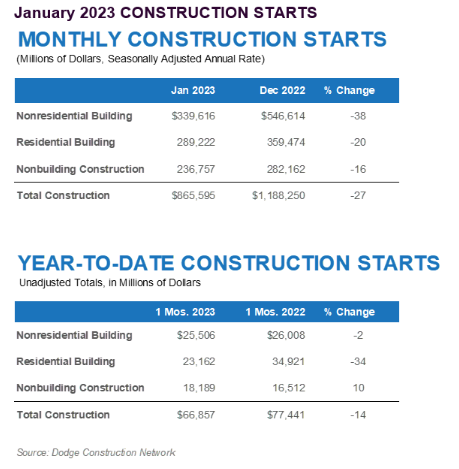

Total construction starts fell 27% in January to a seasonally adjusted annual rate of $865.6 billion, according to Dodge Construction Network. During the month, nonresidential building starts fell 38%, residential starts lost 20%, and nonbuilding starts declined by 16%.

Comparatively, total construction was 14% lower in January 2023 than in January 2022. Nonresidential building starts were down 2%, nonbuilding starts rose 10%, and residential starts lost 34%. For the 12 months ending January 2023, total construction starts were 13% higher than the 12 months ending January 2022. Nonresidential starts were 36% higher, residential starts lost 6%, and nonbuilding starts were up 19%.

“January’s decline in construction starts should not be taken as the beginning of a cyclical downturn in the industry,” said Richard Branch, chief economist for Dodge Construction Network. “Numerous mega-projects have begun over the last few months, obscuring the underlying trend in construction activity. While some construction sectors will face stress as the year progresses, current fundamentals point to an industry that is fairly well positioned to weather the storm.”

• Nonbuilding construction starts fell 16% in January to a seasonally adjusted annual rate of $237 billion. Behind the decline was a very large drop (-76%) in utility/gas plant starts following a brisk December. Elsewhere, environmental public works starts rose 22%, miscellaneous nonbuilding increased 17%, and highway and bridge starts rose 1%.

For the 12 months ending January 2023, total nonbuilding starts were 18% higher than the 12 months ending January 2022. Utility/gas plant starts rose 28%, and highway bridge starts were 20% higher. Environmental public works starts and miscellaneous nonbuilding starts were up 17% and 5% respectively on a 12-month rolling sum basis.

The largest nonbuilding projects to break ground in January were the $750 million High Banks wind farm in Belleville, KS, the $570 million first phase of the Highway 69 express toll lanes in Overland Park, Kansas, and the $492 million CEPP/EAA reservoir in Palm Beach, Florida.

• Nonresidential building starts lost 38% in January to a seasonally adjusted annual rate of $340 billion. Manufacturing starts led the pullback in January, falling 91% following the start of several large projects in December. In January, commercial starts dropped 11% with office being the only category to post a gain; while institutional starts increased by 3% thanks to a large gain in education starts.

For the 12 months ending January 2023, total nonresidential building starts were 36% higher than the 12 months ending January 2022. Manufacturing starts were 190% higher, commercial starts gained 22%, and institutional starts moved 17% higher on a 12-month rolling sum basis.

The largest nonresidential building projects to break ground in January were the $1 billion Prime Data Center campus in Elk Grove Village, Illinois, the $515 million Amazon data center in Hilliard, Ohio, and the $460 million CoStar Group corporate campus in Richmond, Virginia.

• Residential building starts fell 20% in January to a seasonally adjusted annual rate of $289.2 billion. Single family starts lost 5%, and multifamily starts fell 37%. For the 12 months ending in January 2023, residential starts were 5% lower than the 12 months ending in January 2022. Single family starts were 16% lower, while multifamily starts were up 21% on a rolling 12 month basis.

The largest multifamily structures to break ground in January were a $200 million mixed-use building in Gowanus, New York, a $172 million mixed-use building in Greenpoint, New York, and the $150 million The Cove residential community in Sacramento, California.

Regionally, total construction starts in January fell in all five regions.

Learn more at www.construction.com

IAPMO

IAPMO develops and publishes the Uniform Plumbing Code®,the most widely recognized code of practice used by the plumbing industry worldwide; Uniform Mechanical Code®; Uniform Swimming Pool, Spa and Hot Tub Code®; and Uniform Solar Energy, Hydronics and Geothermal Code™ — the only plumbing, mechanical, solar energy and swimming pool codes designated by ANSI as American National Standards — and the Water Efficiency Standard (WE-Stand)™. IAPMO works with government, contractors, labor force, and manufacturers to produce product standards, technical manuals, personnel certification/educational programs and additional resources in order to meet the ever-evolving demands of the industry in protecting public health and safety.

Last modified: March 9, 2023