Broad-based weakness in the building sectors dragged down construction starts

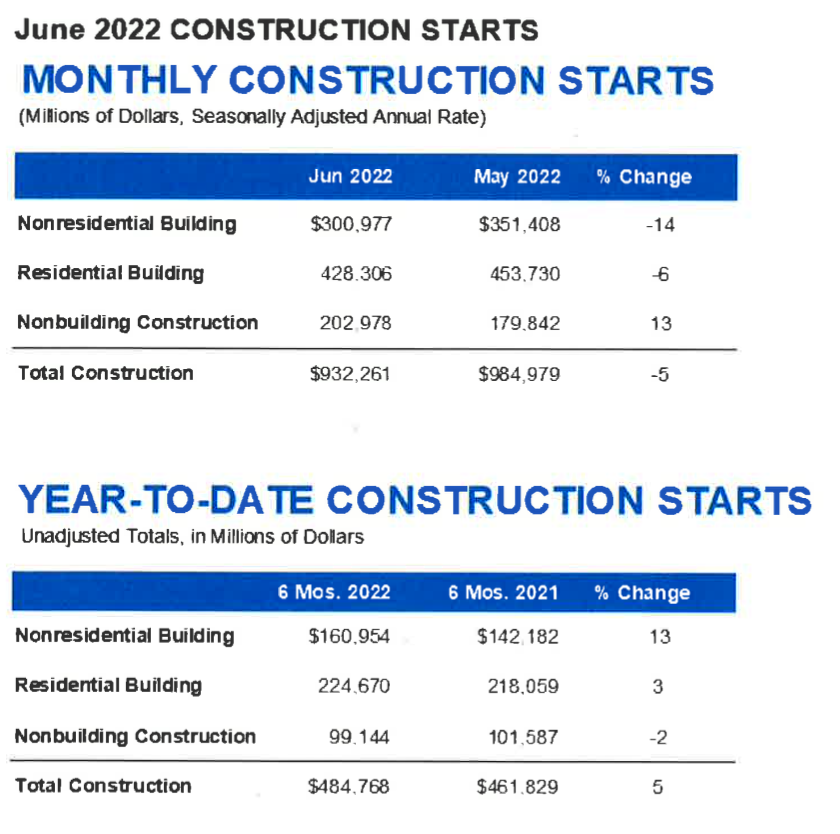

Total construction starts fell 5% in June to a seasonally adjusted annual rate of $932.3 billion, according to Dodge Construction Network.

Nonresidential building starts lost 14% during the month and residential was 6% lower. On the contrary, nonbuilding starts gained 13% in June due to the start of several large solar projects.

Year-to-date, total construction was 5% higher in the flrst six months of 2022 compared to the same period of 2021.

Nonresidential building starts rose 13% and residential starts gained 3%, while nonbuilding starts were 2% lower.

For the 12 months ending June 2022, total construction starts were 7% above the 12 months ending June 2021. Nonresidential starts were 17% higher, residential starts gained 5% and nonbuilding starts were down 2%.

“Construction markets are getting jittery as the odds of recession increase,” said Richard Branch, chief economist for Dodge Construction Network. ‘While projects are still moving through the planning process, the velocity has downshifted reflecting uncertainties over how rising interest rates will impact the economy, construction material prices, and ultimately, construction starts. Over the short-term, construction-facing indicators are likely to be more volatile than normal, particularly in the commercial sector.”

Below is the breakdown for construction starts

Nonbuilding construction starts rose 13o% in June to a seasonally adjusted annual rate of $203.0 billion. Powering the increase was a sharp rise in the utility/gas category due to the start of a large solar project in Nevada and a transmission line through Utah and Wyoming.

Miscellaneous nonbuilding starts rose 21% in June, while highway and bridge starts lost 6% and environmental starts slid 16%.

Through the flrst six months of the year, total nonbuilding starts were 2% lower than in 2021. Highway and bridge starts gained 15% through six months, but environmental public works projects were 4% lower. At the same time, miscellaneous nonbuilding starts dropped 19% and utility/gas plants starts plunged 28% through six months.

For the 1 2 months ending June 2022, total nonbuilding starts were 2% lower than in the 12 months ending June 2021. Environmental public works starts were up 3% and street/bridge starts gained 7%. Miscellaneous nonbuilding starts were 27% lower and utility/gas plani starts were down 5%.

Nonresidential building starts dropped 14% June to a seasonally adjusted annual rate of $301 billion. lt was a broad-based decline for the month, with commercial starts falling 16%, manufacturing starts down 14% and institutional starts moving 12% lower.

Through the first six months of 2022, nonresidential building starts were 13% higher than during the flrst six months of 2021. Commerical starts advanced 14% and institutional starts rose 1%, while manufacturing starts were 83% higher on a year-to-date basis.

For the 12 months ending June 2022, nonresidential building starts were 17% higher than in the 12 months ending June 2021. Commercial starts grew 13%, institutional starts rose 7%, and manufacturing starts swelled 109% on a 12-month rolling sum basis.

Residentialbuilding starts fell 6% in June to a seasonally adjusted annual rate of $428.3 billion. Single family starts dropped 7% and multifamily starts were 3% lower. Through the flrst six months of 2022, residential starts were 3% higher than in the first six months of 2021. Multifamily starts were up 23%, while single family housing slipped 4%.

For the 12 months ending June 2022, residential starts improved 5% from the same period ending June 2021. Single family starts were 2% lower and multifamily starts were 25% stronger on a 12-month rolling sum basis.

Source: www.construction.com

Last modified: July 28, 2022