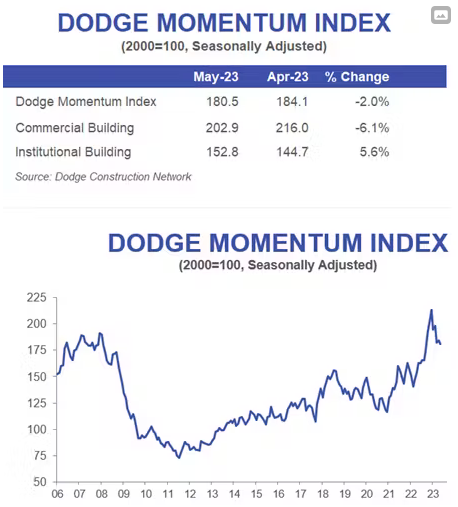

HAMILTON, NJ — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, fell 2.0% in May to 180.5 (2000=100) from the revised April reading of 184.1. Over the month, the commercial component of the DMI fell 6.1%, while the institutional component improved 5.6%.

“The DMI dipped in May amid sustained weakness in commercial planning activity,” stated Sarah Martin, associate director of forecasting for Dodge Construction Network. “Conversely, institutional planning steadily improved over the month as research and development laboratories and hospital projects steadily entered planning.”

Sustained elevation in the federal funds rate and tighter lending standards will likely constrain growth in the DMI over the second half of 2023, she added. “However, the index remains above the historical average. This paints an optimistic landscape for non-residential construction in mid-2024, as the economy recovers and the Fed begins to pull back rates.”

Commercial planning in May was negatively impacted by continued weakness in office and hotel planning activity. Institutional planning accelerated alongside steady growth in education, health and amusement projects. Year over year, the DMI remains 11% higher than in May 2022. The commercial and institutional components were up 7% and 18%, respectively.

A total of 30 projects valued at $100 million or more entered planning in May. The largest commercial projects included Buildings 3 and 4 of the Blue Sky Data Center project in Omaha, NE, each valued at $466-million, and the $400-million Prime Data Center building in Avondale, AZ. Leading the way on the institutional side were the $500-million Tennessee Performing Arts Center in Nashville, and the $440-million Rady Children’s Hospital ICU/EMS Pavilion in San Diego, CA.

- Watch DCN’s Sarah Martin discuss May’s DMI here.

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

Meanwhile, hiring remains strong

On June 5, according to the establishment survey of the Bureau of Labor Statistics (BLS), nonfarm payrolls rose by a seasonally adjusted 339,000 in May, far exceeding expectations and marking the 29th straight monthly increase in employment. The BLS household survey shows that the nation’s unemployment rate rose from April’s 3.4% to 3.7%, as the number of unemployed households rose.

Construction employment rose by 25,000 in May, following an increase of 13,000 in April.

Employment gains were broad-based with gains in nonresidential sectors amounting to 22,100. Over the prior 12 months, construction had added a monthly average of 17,000 jobs. The May increase in residential building construction (+2,400 jobs) was particularly heartening and perhaps another sign that single family home construction is at the bottom of the cycle and will show improvement in the second half of the year.

The construction unemployment rate dropped to 3.5% in May, from 4.1% a month earlier. Meanwhile, average hourly earnings in construction increased 0.4% in May (+5.1% on a year-over-year basis), faster than overall wage growth as construction labor continues to be scarce in the face of strengthening starts activity.

Despite its resiliency, construction employment faces strong headwinds in the short term. The BLS jobs report increases the odds of another Federal Reserve rate hike at the June meeting. Higher interest rates for a longer period, tighter lending standards and turmoil in the banking sector do not bode well for construction starts and employment.

Also, announcements of job cuts in the sector, as reported by Challenger, Gray & Christmas, eased in May. But they are still significantly higher in the first five months of this year (+2,585) than during the same period a year earlier (+1,150). Such announcements could increase over the next several months.

Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry.

The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem.

Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction.

Dodge Construction Network

Dodge Construction Network is a solutions technology company providing an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers longstanding and trusted industry solutions to timely connect and enable decision makers across the entire commercial construction ecosystem. For more than a century, Dodge Construction Network has empowered construction professionals with the information they need to build successful, growing businesses. To learn more, visit construction.com

Last modified: October 19, 2023